Recently, I learned about Norbert’s Gambit, and it seems like a really nice way to avoid paying currency conversion fees. You still end up paying something, but depending on the amount you’re converting, the fees can be pretty small — I’ll illustrate this later.

So what is Norbert’s Gambit? Norbert’s Gambit is a strategy used to convert Canadian dollars (CAD) to U.S. dollars (USD) (or vice versa) by buying and selling interlisted stocks or ETFs — stocks that trade on both Canadian and U.S. exchanges. The idea is simple:

- Buy the stock in CAD on the Canadian exchange.

- Transfer the stock to the U.S. exchange.

- Sell the stock there in USD — effectively converting your money with minimal fees.

As I mentioned, this method helps avoid conversion fees that banks, brokers, and private exchanges charge. Here’s what I’ve seen:

- Banks: Typically take 3–5 cents per dollar (3–5%).

- Brokers (InvestorLine in my case): Around 2 cents per dollar (2%).

- Private exchanges near me: About 1 cent per dollar (1%).

Fees of 1–5 cents per dollar might not seem like much at first, but they add up fast—especially for larger amounts. For example, if you exchange $10,000 CAD, the fees would be ~$300–$500 for bank, ~$200 for broker and ~$100 for private exchange. Now think about your entire retirement fund — suddenly, those fees don’t look so small.

Norbert’s Gambit isn’t completely free. Here’s what you still have to factor in:

- Trading fees: InvestorLine charges $10 per trade, so buying and selling costs $20 total.

- Stock price movement: Prices fluctuate, so there’s a chance the value changes before you sell.

- Market spread: The difference between bid and ask prices can result in a small loss.

That said, InvestorLine does automatic online transfers, so there’s no need to call anyone or wait a day — minimizing the risk of price movement. To test it out, I ran a small experiment:

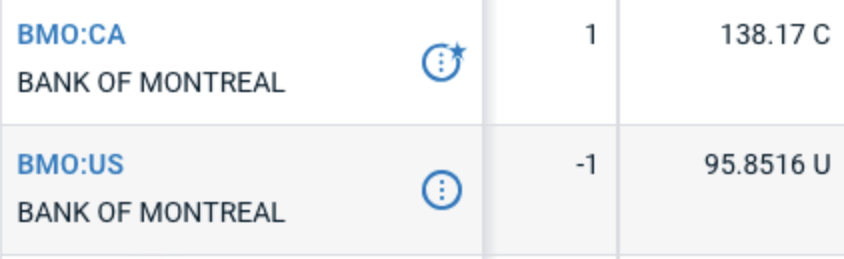

- Bought 1 share of BMO:CA for $138.17 CAD

- Sold 1 share of BMO:US for $95.8516 USD

- Effective exchange rate: 0.694

- Market exchange rate at the time: 0.693

I actually gained about 10 cents per exchange, but that was just luck due to market fluctuations going my way. Now let’s extrapolate and assume things didn’t go in my favor. If I exchanged $13,817 CAD, I’d buy 100 shares of BMO:CA and sell them in USD at an effective exchange rate of 0.692 instead of the market rate of 0.693.

- Norbert’s Gambit: 0.692 × $13,817 = $9,561.364 USD

- Official exchange rate: 0.693 × $13,817 = $9,575.181 USD

- Loss due to the exchange rate difference: $9,575.181 − $9,561.364= $13.817 USD

So, I lost $13.82 USD due to the slightly market volatility. If I had used a private exchange instead (charging 1 cent per dollar), the fees would have been: $9,575.181 – (13817 * 0.683) = $138.17 USD. That’s 10 times more expensive than my $13.82 USD loss from Norbert’s Gambit! Now, let’s add in the trading fees: 20 USD + 13.82 USD (loss) = $33.82 USD total cost. Even after including the trading commission, the total cost is still way lower than the $138.17 fee from the private exchange.

In my mind, Norbert’s Gambit is an awesome strategy, especially considering that Canadian investors have to exchange currency at least twice in their lifetime — once to invest and again to cash out for retirement. This means Norbert’s Gambit can save Canadians around 2% on foreign investments.

Thank you for your article. I have been searching online for weeks for a detailed process of executing this Norbert’s Gambit method on BMOIL. Your article is the most elaborate one. May I ask you a question, will the plus and negative CA/US shares automatically offset to zero balance afterwards? Or do I have to call a BMOIL agent to ask for a manual offset? Thanks.

Hey @Adrian — yes, the CAD and USD sides usually reconcile automatically on the next business day. No need to call.

Thanks! I’ve been hesitating to do this strategy because all instructions I found is about other platforms like Questrade or RBC, which is not the same as BMO. I will give it a try now.

You are welcome.